Companies providing or administering Medicare Advantage (MA) plans commit fraud when they, or a contractor, knowingly submit risk adjustment data to the Centers for Medicare & Medicaid Services (CMS) that are inaccurate or ineligible for payment under CMS rules, often by inflating the risk profile of patients. Such companies and contractors are subject to the False Claims Act (FCA).

The FCA makes it illegal for government contractors to knowingly submit false claims for payment to the federal government. When a MA company or contractor engages in Medicare risk adjustment fraud and makes a claim for payment from the government, it has violated the FCA. Whistleblowers who report MA fraud are entitled to 15-30% of the amount recovered for bringing the illegal conduct to light. It some instances, this can amount to millions or tens of millions of dollars awarded to FCA whistleblowers.

A vice president of a healthcare system brought a successful FCA lawsuit that settled for $32.5 million, resolving FCA allegations that the healthcare company submitted to Medicare false risk adjustments as to their members’ medical conditions, which boosted the Medicare payments the company received.

What is Medicare Advantage Fraud?

In many cases, MA fraud occurs by claiming risk adjustment payments for exaggerated medical conditions that beneficiaries were not treated for or may not even have. When a patient’s risk profile is falsely inflated, it means more money for the insurer.

Also known as Medicare Part C, MA is a private plan option for beneficiaries that covers all Part A and B services, except hospice. Under MA, private health insurance companies operate a managed care model. The goal of this model is to reduce costs by coordinating care for beneficiaries. The capitated monthly payment is made to these private health insurers, called Medicare Advantage Organizations (MAOs), regardless of how many or how few services a beneficiary actually uses.

Unlike a traditional fee-for-service reimbursement plan, the government uses a capitated monthly payment structure for MA plans. The capitated payment model is a cost-savings strategy in which CMS pays MA plans a per-member, per month sum to provide care to beneficiaries. However, to ensure that all beneficiaries receive proper care, no matter how costly their disease or condition may be, CMS allows for “risk adjustment” payments. These risk adjustments are aimed at preventing insurers from avoiding sicker beneficiaries.

Despite the best of intentions, these risk adjustments create the opportunity for insurers to commit fraud. With roughly 30 million individuals enrolled with Medicare Part C, the government relies heavily on whistleblowers to uncover MA fraud.

A California-based hospital system paid $30 million to resolve allegations that it submitted unsupported diagnosis codes to CMS, exaggerating patient conditions, that caused overpayments by CMS to the MA plan.

What are Risk Adjustments?

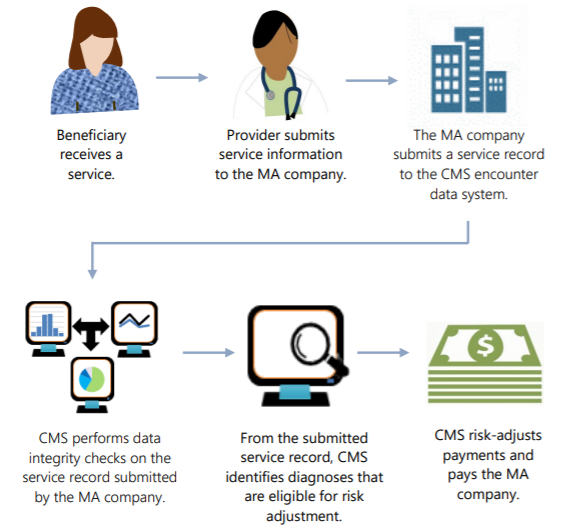

Risk adjustment payments are calculated based on members’ diagnoses and corresponding “risk score.” Under the CMS calculation, the sicker a beneficiary is, the higher risk score the patient receives. The process of determining the proper score for a MA beneficiary is called “risk adjustment.” Factors used to calculate risk adjustment include age, gender, disability status, institutional status, and health status. MAOs can receive increased payments by submitting risk adjustment claims.

The Risk Adjustment Process

Risk adjustment claims must include medical records showing that:

Risk adjustment claims must include medical records showing that:

-

- the beneficiary has the given diagnosis;

- treatment of the diagnosis was done by a qualified provider;

- treatment of the beneficiary occurred during the relevant treatment year; and

- treatment was provided via a face-to-face visit.

Risk adjustments can be worth thousands of dollars every year for MA plans. Given the money involved, MA plans put significant resources to ensuring the highest risk score possible and reporting beneficiary diagnoses to CMS.

What is Risk Adjustment Fraud?

MA plans are vulnerable to a variety of fraudulent practices aimed at improperly inflating beneficiaries’ risk scores and, thus, fraudulently increasing risk adjustment payments from CMS. Generally speaking, risk adjustment fraud occurs when MA plans represent that patients are sicker than they actually are, which causes CMS to overpay for the MA beneficiaries’ treatment.

Some examples of risk adjustment fraud include:

-

- Upcoding beneficiaries’ diagnoses to inflate the risk score and exaggerate their condition;

- Submitting risk adjustment claims that aren’t supported by proper medical documentation;

- Creating false documentation to support an improper diagnosis and related reimbursement claim;

- Failing to correct a false or improper claim when the MA plan learns or reasonably should know, that the claim is unsupported;

- Failing to comply with audit obligations;

- Improperly avoiding obligations to repay to the government monies to which the MAOs or others were not entitled;

- Failing to submit accurate, complete, and truthful patient encounter data; and

- Failing to maintain adequate fraud and abuse prevention and compliance programs.

A Washington-based health plan agreed to pay $6.3 million to resolve an FCA case brought by a former medical billing manager alleging that it submitted invalid diagnoses for MA beneficiaries and received inflated payments from CMS as a result.

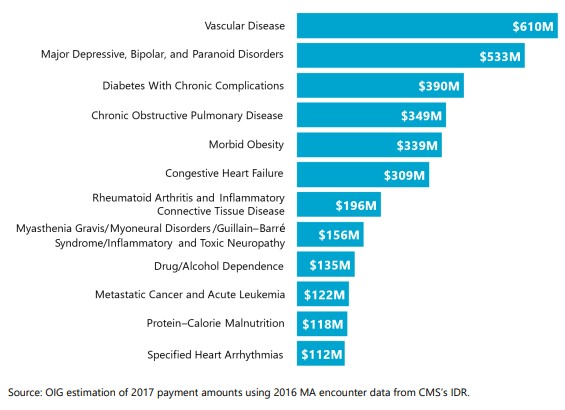

12 health conditions drove billions in risk adjustment payments.

Contact Halunen Law Medicare Advantage Fraud Attorneys

If you know about a risk adjustment scheme or any other form of MA fraud against the government, the whistleblower attorneys at Halunen Law stand ready to support you as you consider whether and how to report the misconduct. We’ve recovered billions of dollars working with whistleblowers who had the courage to do the right thing and millions of dollars in compensation for individuals who experienced retaliation as a result.